“Money is not the only answer, but it makes a difference.”

—Barack Obama

Ever wondered who decides how much cash your wallet can actually buy each month? Or why does your home loan interest rate jump overnight while your salary doesn’t?

That, my friend, is usually the silent hand of Bangladesh Bank at work.

This blog isn’t a classroom lecture. It’s a walk-through for anyone who has ever opened a bank account, transferred money abroad, started a business, or is just curious about what this mysterious “central bank” actually does. Let’s talk about purpose, power, people, and perception—the core 4Ps of Bangladesh Bank. And how they affect you, not just the headlines.

What Is the Bangladesh Bank, Really?

Bangladesh Bank (BB) isn’t just some upper-floor government office with suited officials. It’s our central bank, the apex body that holds the strings to Bangladesh’s entire financial ecosystem.

- Established: It all started on December 16, 1971, when Bangladesh became independent and took over the Dhaka branch of the State Bank of Pakistan.

- Formally Instituted: The Bangladesh Bank Order of 1972 set the rules for how the bank works, what it can do, and what its legal duty is.

- Headquarters: Motijheel, Dhaka.

- Legal Identity: Fully state-owned, but operates with autonomy under its founding Act.

- Governor Appointed By: The Government of Bangladesh. Although BB’s policies and enforcement capabilities are based on tight legal and economic foundations, not day-to-day politics.

- Vision: Stable prices, financial growth that includes everyone, and a strong economy for the long term.

And here’s where the everyday connection starts:

- Issues all legal tender in Bangladesh; you won’t find a single Taka without BB’s signature.

- Holds and manages the country’s foreign reserves, keeping the exchange rate from going haywire.

- Acts as banker to the government, clearing its payments and managing its public debt.

- Supervises every licensed financial institution, including scheduled banks, non-scheduled banks, and even microfinance bodies.

- Monitors risk zones (you may have seen Red/Yellow/Green Zone classifications) and can step in to restructure or restrict troubled banks.

- Implements a monetary policy every six months that quietly determines how expensive your loan is or how valuable your salary will be.

- Has the authority to stop shady transactions, cancel licenses, or step in when the public’s interest is on the line.

- Works closely with global bodies like the IMF and World Bank on trade matters, debt updates, and regulatory reporting.

- Leads digitization efforts for Bangladesh’s financial system: think mobile banking, e-TIN validation, and e-wallet guidelines.

But no, BB won’t give you a debit card or a loan. It’s the bank that your bank obeys.

That Taka note in your hand? BB printed it.

That bank loan interest hike? BB pulled the trigger.

That alert about a bank in crisis? BB’s warning label.

It might not be in your inbox, but it’s very much in your wallet, your EMI, your savings, and your monthly grocery list.

The Real Role of Bangladesh Bank

Let’s talk about the role of the Bangladesh Bank, without overcomplicating it. Here’s a brief list of what this central bank actually does, in ways that quietly shape the finance of the country, your day, your business, and your bottom line:

- Controls Inflation & Interest Rates

When the price of groceries creeps up faster than your paycheck, BB adjusts how expensive it is for banks to lend or borrow money. That directly impacts your home loan rate or the cost of running a business.

- Issues Currency & Manages Forex Reserves

Every single Taka note in your wallet, legally stamped and circulated by BB. It also manages how much foreign currency enters or exits the country, keeping the USD-BDT balance from becoming a panic button.

- Supervises the Money Supply

Too much cash in the market? Prices explode. Too little? Growth stalls. BB controls that thin line by setting how much money banks can actually loan out, using tools like CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio).

- Regulates Scheduled & Non-Scheduled Banks

From big-name commercial banks to specialized and non-scheduled ones, BB plays referee. It monitors their health, checks risk levels (think Red Zone talk), and pushes banks to fix their act, or merge, if necessary.

- Supports Foreign Investment & Trade

For any foreign investor trying to send money in, or pull profits out, BB steps in. From approving foreign loan flows to verifying repatriation requests, it links up with BIDA, custom authorities, and even local banks.

- Publishes Monetary Policy Statements

Twice a year, BB lays out its action plan for the economy: interest trends, liquidity expectations, foreign exchange outlook. It’s called the Monetary Policy Statement, and if you’re a startup, factory owner, or export manager, you should keep an eye on it.

It also quietly signals what’s coming; whether credit will get tighter or cheaper, giving banks and businesses a feel for the financial weather ahead.

- Protects Depositor Interest & System Stability

BB is also the one standing between you and a potential banking crisis. If a bank’s lending becomes reckless, BB doesn’t just “watch,” it steps in. From audit orders to limiting withdrawals, it works to protect the everyday depositor.

- Acts as the Government’s Banker

Bangladesh Bank holds accounts for ministries, manages public debt instruments, and processes large-scale disbursements like salary payments for government employees. It’s the reason Sonali Bank, for instance, channels public payroll or pension funds—BB coordinates the backend.

- Oversees the National Payment System

Every card swipe, BEFTN transfer, or MFS transaction? Runs through the systems BB supervises. It ensures banks, mobile wallets, and even fintech startups don’t play fast and loose with your money’s movement. This is also how interoperability between bKash, Rocket, and traditional banks gets smoother every year.

- Lender of Last Resort

When a bank hits a liquidity wall, like not having enough to pay back depositors, BB decides whether to offer emergency funds. This is how it stops fear from turning into a full-blown bank run. It’s a big reason why your savings don’t just disappear during crises.

- Combats Money Laundering

BB leads the financial side of anti-terror and anti-corruption efforts. Through the Bangladesh Financial Intelligence Unit (BFIU), it tracks suspicious transactions and issues alerts. If someone tries to mask shady transfers as remittance or fake trade, this is the watchdog catching it.

- Drives Financial Inclusion

Beyond big banks and top CEOs, BB also pushes banks to reach farmers, women-led microenterprises, and underserved regions. Its agent banking policies, digital banking approvals, and rural banking mandates are how startups and villagers can open accounts without stepping into a bank branch.

- Serves as Economic Advisor

Behind every budget policy or interest cap debate, you’ll find BB’s quiet reports. From publishing data on inflation to advising the Ministry of Finance, BB plays a key role in steering national decisions, often before they’re made public.

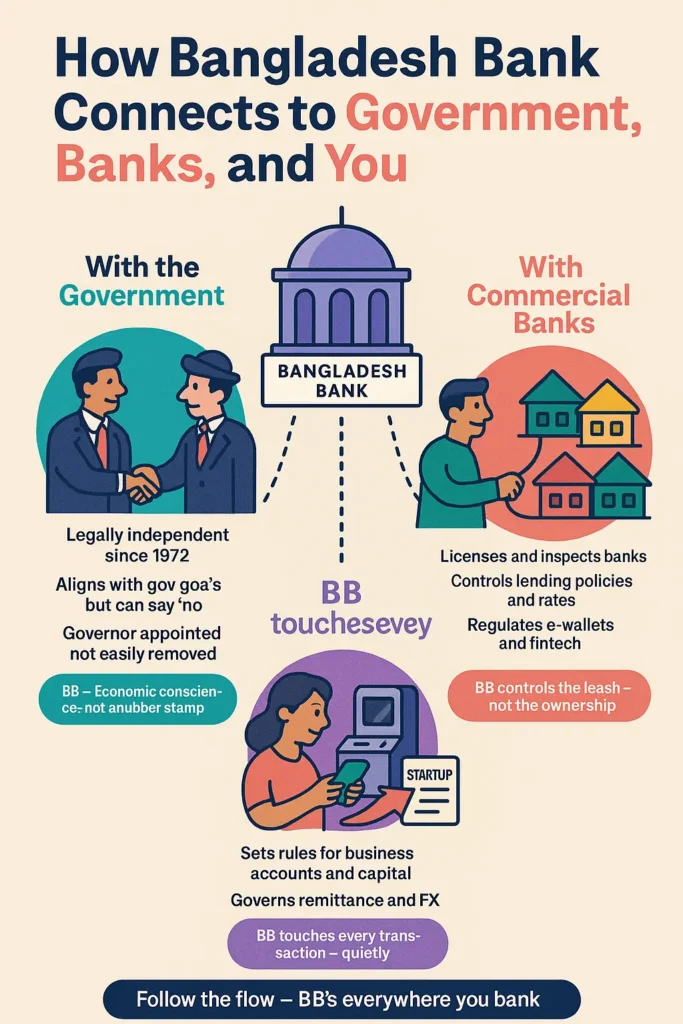

How Bangladesh Bank Connects to the Government, Banks, and You

Bangladesh Bank sits in a strange but powerful position. It’s not a typical ministry, and it doesn’t change with elections. Yet, it works side-by-side with the Ministry of Finance and other regulators like NBR or BIDA.

Here’s how it all flows:

Government Link

- BB was established under the Bangladesh Bank Order, 1972, giving it legal independence.

- The Governor is appointed by the government, but cannot be easily removed or pressured politically.

- It aligns with government goals (like lowering inflation or expanding SME credit), but has the power to say “no” when financial stability is at stake.

- Think of BB as the economic conscience, not a rubber stamp.

With Commercial Banks

- BB doesn’t own banks, but it controls their leash.

- It licenses scheduled banks, inspects them, and, when necessary, calls them out in red/yellow/green lists.

- It decides how much banks can lend, at what rates, and with what reporting discipline.

- It even monitors who gets to operate e-wallets, foreign accounts, or new fintech services.

And With People Like You

- You may not interact with BB directly, but your bank does.

- From business account approvals to startup capital regulations, BB sets the rules.

- It governs remittance channels, foreign exchange rates, and cross-border payments; these are vital if you’re working abroad or setting up your first venture.

- It’s the quiet referee behind every bank transfer, import LC, or ATM withdrawal.

Tools Bangladesh Bank Uses to Keep Money in Check

Bangladesh Bank doesn’t sit back and hope the economy behaves. It intervenes, deliberately, and often silently, with a toolkit that’s tested and backed by law.

Here’s how BB keeps your taka from losing its value, your loan from becoming impossible, and the whole system from going off the rails:

Repo Rate & Reverse Repo Rate

Think of this like the interest BB charges or pays when it deals directly with commercial banks.

- When BB lends money to banks, it charges the repo rate, a bit like saying, “You need quick cash? Here’s the cost.”

- When banks park their excess money with BB, it pays them the reverse repo rate; a little thank-you for not flooding the economy with extra credit.

Together, these rates tell banks: Should you lend more, or hold back? And that ripple hits everything from your EMI to business capital.

Cash Reserve Ratio (CRR)

This is the minimum amount of cash a bank must keep parked with the Bangladesh Bank; untouchable, unloanable. It’s a buffer.

Why? Because if every customer came knocking for their money at once (a bank run), this reserve is the emergency vault. It also helps tighten the money supply when inflation’s rising.

Statutory Liquidity Ratio (SLR):

This one’s like the cousin of CRR, but instead of cash, it includes safe assets like treasury bills, gold, and bonds.

BB uses SLR to make sure banks don’t overextend themselves. If the market is getting “too hot,” BB tells banks to stash more in these liquid assets, cooling the economy gradually without panic.

Monetary Policy Statement (MPS)

Twice a year, BB lays its cards on the table.

This isn’t just paperwork. It’s a directional signpost for the next six months, covering everything from inflation targets to lending trends, reserve levels, and exchange rate predictions.

If you’re a business owner, a startup, or someone saving up for a big investment, this document tells you: Is the tide in your favor, or is it time to wait it out?

Bangladesh Bank also shapes how imports happen, clears exports, and approves digital payments, affecting everything from cross-border eCommerce to how fast fintech grows.

Why Should YOU Care?

Because Bangladesh Bank quietly shapes your financial life:

- Entrepreneurs: Your business loan or trade approval depends on BB policy

- Wage Earners: Inflation eats up your salary? BB decides how to fight it

- Remitters: Your hard-earned dollars need BB’s FX rules to enter smoothly

- Students & Families: Savings returns, EMI rates, all influenced by BB’s stance

Even for something like Trademark Protection or Setting Up in BEZA or Hi-Tech Parks, your finances eventually pass through a BB checkpoint.

Now, Why Foreign Entrepreneurs Should Care

So you’re not a Bangladeshi citizen, but you’re investing, exporting, or opening a branch here? Well, you’re already under Bangladesh Bank’s umbrella.

- BIDA Approval Isn’t Enough. Without BB’s nod, your capital can’t legally enter or exit. Think of it as the backstage pass to your investment flow.

- Loan Access? Whether you’re applying for startup funds or a commercial facility, your eligibility and currency terms are shaped by BB’s policies.

- Business Bank Accounts? BB sets the rules banks follow when verifying foreign documentation or allowing repatriation.

- Registering a Company? If your startup includes foreign ownership or capital injection, your bank must notify BB. RJSC might issue the certificate, but BB tracks the money trail.

- Taka Exchange Value? It directly affects your ROI. A BB-managed rate ensures your dollars don’t drown in fluctuation.

- Want to pull profits out later? BB checks that your funds are legitimate before they approve anything going out.

In short, Bangladesh Bank might not be on your company’s letterhead, but it’s always on your balance sheet.

Bangladesh Bank, Government & Private Banks: Who’s Really in Charge?

Bangladesh Bank is not a passive observer; it’s the regulator both government and private banks report to. Whether it’s Sonali Bank disbursing salaries or a flashy private bank launching a digital app, BB sets the rules. From how much they can lend, to how they manage risk, to who they can onboard as clients, it’s BB’s call.

And foreign banks operating in Bangladesh? Yes, they’re here too; Standard Chartered, HSBC, but even they must play by BB’s policy book. No one gets a free pass.

In the end, if banks are the players, BB is the referee. Quiet, firm, and always watching the score.

Final Thought: The Institution Behind the Ink

You may never shake hands with the Governor (the Bangladesh Bank Governor, I mean). But your wallet, your EMIs, your remittance from Dubai, your startup capital, all touch our central bank’s policy.

It doesn’t just regulate banks. It regulates our confidence in the Taka, our faith in savings, and the pulse of Bangladesh’s economic life.

Bangladesh Bank isn’t a loud institution. But its silence often speaks louder than the budget speech.

“Central banking isn’t about controlling everything. It’s about keeping what matters steady.”

And that’s what BB quietly does.

FAQ

Why does the Bangladesh Bank control how much money banks can lend?

Answer: Because unchecked lending can crash an economy. If banks lend too much, prices shoot up. If they hold back, businesses choke. Bangladesh Bank finds the sweet spot, deciding how much money stays put and how much moves. It’s like handling a water tap: too tight or too loose, and the whole system feels it.

Is Bangladesh Bank politically controlled?

Answer: Not directly. Yes, the government chooses the Governor, but Bangladesh Bank strictly follows the Bangladesh Bank Order, 1972. And that Order gives the bank room to breathe when it comes to things like monetary policy, oversight, or dealing with inflation. Think of it like a referee in a game; it’s close to the action, but it doesn’t take sides.

Can Bangladesh Bank freeze my account?

Answer: Yes, but not at random, if I’m being honest. Bangladesh Bank can temporarily suspend your account for inquiry, through its Financial Intelligence Unit (BFIU), if it looks like you’re laundering money, funding terrorism, or making huge transfers that don’t make sense. It’s like stopping, not freezing or canceling entirely.

Why does the Bangladesh Bank decide when to print new money?

Answer: Because printing money isn’t about having “more,” it’s about avoiding “too much.” Too much cash chasing the same number of goods means inflation. BB checks inflation, reserves, and money demand before even touching the print command.

How does BB affect the foreign exchange rate?

Answer: Every time dollars flow in (remittance, exports) or out (imports, foreign education), BB watches. It holds USD reserves and intervenes when the taka is in trouble. Whether you’re sending money abroad or converting your earnings, BB’s decisions shape how far your taka goes.

Is Bangladesh Bank behind those “Red Zone” bank warnings?

Answer: Absolutely. BB monitors the health of all banks using strict benchmarks for capital adequacy, default loan ratios, and management quality. When a bank enters risky territory, BB marks it Red or Yellow, pushing it to improve. It’s like a traffic light for depositors: red = proceed with caution or don’t proceed at all.