Let’s start with this: how many apps do you have on your phone for money stuff? bKash, Nagad, maybe an app or two from your bank? We rely on them like second nature. But beneath all this digital convenience sits something much older and bigger: the commercial banking system. It’s not just where you park your salary. It’s what keeps the country’s economy breathing.

And yes, I get it. Banking talk sounds dry. But stick around, because I’m about to make this real. So, Folks, let’s talk about commercial banks in Bangladesh.

What Are Commercial Banks in Bangladesh?

Imagine a place that doesn’t just keep your money safe but makes money by using yours. That’s a commercial bank.

Definition: A commercial bank is simply a place where people and businesses keep their money, borrow when they need to, and the bank earns its living through interest, fees, and the services it offers.

Objective: Serve public interest while making a profit. Yep. Two birds. One bank.

These banks aren’t charity houses. They want to grow. But they still need to follow Bangladesh Bank’s rules and serve common people, small businesses, corporates, and even foreign investors trying to break into Bangladesh’s booming sectors.

Example? City Bank giving out SME loans to rural businesses. BRAC Bank helping freelancers open accounts digitally. Or Commercial Bank of Ceylon processing cross-border remittance from the Maldives.

Overview of the Commercial Banking System in Bangladesh

The structure of banking in Bangladesh is like a pyramid:

At the top? Bangladesh Bank (the central bank), the big regulator.

Under that:

- State-owned commercial banks

- Private commercial banks

- Foreign commercial banks operating in Bangladesh

All of them are closely watched by the Bangladesh Bank, following rules like Basel III and Anti-Money Laundering guidelines. If you’re wondering how these rules actually work in real life, just check out the red, yellow, and green zone indicators used to show different levels of risk in the country’s banking system.

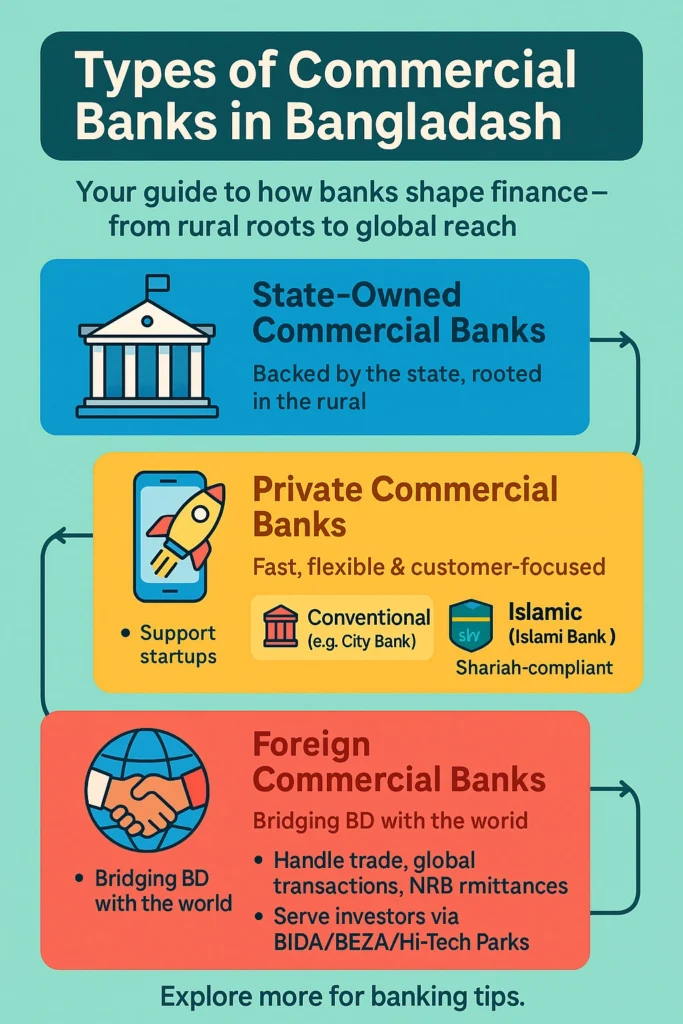

Types of Commercial Banks in Bangladesh

Yeah, not all commercial banks wear the same suit!

You see “commercial bank” and might assume it’s just one thing. But in Bangladesh, these banks come in three distinct flavors, each serving a slightly different role in the big financial puzzle.

Here’s how they’re split:

- State-Owned Commercial Banks

Also called SoCBs, these are the oldest players, backed by the government. Think of them as the dependable, all-rounders who still run many of the essential public services.

- Examples: Agrani Bank, Sonali Bank, Janata Bank, Rupali Bank.

- What they do: They show up where most banks don’t: setting up branches in remote villages and rural corners, bringing government salaries straight to people’s hands, managing pension money with care, and staying right in the middle of the big infrastructure projects.

- Reality check: Some still rely on paperwork and manual processes. But they’re modernizing, slowly but surely.

- Private Commercial Banks

This is where most of the action happens now. They’re independently owned but follow strict rules set by the Bangladesh Bank.

- Examples: BRAC Bank, City Bank, EBL, Dutch-Bangla Bank

- What they do: They create mobile apps that actually work for people, back bold new startups with heart, make customer support less of a headache, turn onboarding into something you don’t dread, and offer loan options that make sense for how real life works.

- Split further into:

- Conventional Private Banks (like City Bank, Prime Bank)

- Islamic Private Banks (like Islami Bank, Al-Arafah Islami Bank): Islamic banks strictly follow Shariah law. Which means their entire banking system avoids interest and interest-based loans. Instead, these banks focus on ethical, partnership-based finance.

These are often the go-to for foreigners setting up businesses or opening accounts. If you’re curious, start with topics like How to Open a Business Bank Account in BD as a Foreigner.

- Foreign Commercial Banks

They’re not just running branches in Bangladesh. They’re building bridges between Bangladesh and the global financial stage.

- Examples: Standard Chartered Bank, Commercial Bank of Ceylon, Woori Bank.

- What they do: They handle large-scale transactions, help with trade deal negotiations, manage money sent from overseas, look after accounts for international investors, and offer banking services in both local and foreign currencies.

- Fun fact: Some banks, such as Commercial Bank of Ceylon, even allow NRBs (Non-Resident Bangladeshis) to send money home right away. Direct from the Maldives to a bank account in Bangladesh.

If you’re an investor working under BIDA, BEZA, or in a Hi-Tech Park, these banks often step up with customized support, especially when it comes to things like sending profits back home or registering your foreign-backed company.

Number of Banks and Commercial Banks in Bangladesh (2025 Update)

As of 2025, Bangladesh’s financial sector includes:

| Type of Bank | Count |

| Total Scheduled Banks | 61 |

| Total Commercial Banks | 53 |

| – Private Commercial Banks | 43 |

| – State-Owned Commercial Banks | 6 |

| – Foreign Commercial Banks | 4 |

| Specialized Banks (like BKB, RAKUB) | 2 |

| Other Non-Scheduled Institutions | 5+ |

Yes, that’s a lot of banks, but not all are equal when it comes to tech, capital strength, or customer service.

Complete List of Commercial Banks in Bangladesh (2025)

Here’s a breakdown of the major commercial banks by type:

| Name | Type | Year Established | Website |

| Sonali Bank Limited | State-Owned | 1972 | sonalibank.com.bd |

| Janata Bank Limited | State-Owned | 1972 | janatabank-bd.com |

| Agrani Bank Limited | State-Owned | 1972 | agranibank.org |

| Rupali Bank Limited | State-Owned | 1972 | rupalibank.org |

| City Bank | Private Commercial | 1983 | thecitybank.com |

| BRAC Bank | Private Commercial | 2001 | bracbank.com |

| EBL (Eastern Bank Limited) | Private Commercial | 1992 | ebl.com.bd |

| DBBL (Dutch-Bangla Bank Limited) | Private Commercial | 1995 | dbbl.com.bd |

| Islami Bank Bangladesh Limited | Private Commercial (Islamic) | 1983 | islamibankbd.com |

| Commercial Bank of Ceylon (BD) | Foreign Commercial | 2003 (BD branch) | combank.net.bd |

Note: To see the entire current list of all private, state-owned, and international commercial banks, check out official Bangladesh Bank directories and trusted sources.

First Private and Largest Commercial Bank in Bangladesh

- First private commercial bank? City Bank Limited, established in 1983.

- Largest commercial bank? That’s Sonali Bank if you go by government ownership and asset size. But when it comes to private banks, BRAC Bank and Islami Bank really stand out. They’re taking the lead in supporting small businesses, going digital, and helping people send money back home with less hassle.

Functions of Commercial Banks in Bangladesh

Let’s not reduce banks to just account openers or loan pushers. In Bangladesh, commercial banks wear multiple hats, and if you look closely, they quietly power everything from your online purchases to infrastructure projects. Here’s how they actually work:

1. Safekeeping Your Money (Deposits)

This is the most basic function, but also the most vital.

- You can open a savings, current, or fixed deposit account, even a DPS for long-term savings.

- Most banks now offer mobile alerts, so every deposit, withdrawal, or interest credit pings your phone in real-time.

2. Lending & Credit Support

Banks turn deposits into opportunity by lending to:

- Small businesses (SMEs) looking to grow

- Salaried individuals needing personal or home loans

- Large companies funding expansion or payroll

Foreigners setting up shop? Yes, banks also provide business loans to approved foreign entrepreneurs, as long as you meet the local compliance steps.

3. Handling Trade & Remittance

Whether you’re sending goods abroad or sending money home:

- Banks issue Letters of Credit (L/C) for international trade

- They process foreign remittance securely, directly to your account or via mobile-linked options like Rocket or bKash

This is crucial for NRBs and anyone operating across borders.

4. Digital Banking Tools

Banking’s gone mobile. literally.

- Apps like Astha, CityTouch, or Rocket let you check balances, pay bills, apply for loans, and even do live selfie verification.

- Some banks offer virtual debit cards for secure online shopping or freelancing.

5. Agent Banking & Rural Inclusion

Here’s where banking goes beyond Dhaka or Chattogram.

- Through agent banking booths, people in remote areas can now open accounts, receive remittances, or apply for small loans, everything without ever stepping into a full branch.

- Islamic banks and state-owned ones have been leading this expansion.

In short? Commercial banks in Bangladesh don’t just move money. They move people toward growth, safety, and bigger dreams.

Credit Risk Management of Commercial Banks in Bangladesh

Let’s not sugarcoat it; lending money is a gamble. Whether it’s a big company asking for working capital or a small shopkeeper applying for a seasonal loan, there’s always that looming question: Will they pay it back?

That’s where credit risk management comes in. For commercial banks in Bangladesh, this isn’t just a compliance checkbox. It’s a daily survival skill.

So, What Exactly Is Credit Risk?

It’s the possibility that a borrower won’t pay back the loan on time, in full, or at all. And for a bank, even a small rise in defaults can shake the entire system. Especially in an economy like Bangladesh, where thousands of businesses still rely on bank loans to grow.

How Do Banks in Bangladesh Manage Credit Risk?

Let me break it down like we’re having a lively conversation over a cup of coffee:

- They screen you deeply.

Banks rely on independent credit rating agencies like CRISL, Alpha Credit Rating, and Emerging Credit Rating to get a clearer picture of who they’re lending to. These agencies dig into how steady your income is, how you’ve handled loans before, and whether you usually pay on time. If your score doesn’t meet the mark, the bank might turn you down or ask for extra security before moving forward.

- They play by Bangladesh Bank’s rules.

The central bank doesn’t just sit around. It lays down clear rules through what’s known as the risk-based capital adequacy framework (yep, that’s part of Basel III). In simple terms, it means every bank has to keep a safety cushion of capital, depending on how big and risky its activities are. Sort of like saving up just in case some loans don’t get paid back.

- They monitor something called the NPL ratio.

This one matters. NPL (Non-Performing Loan) ratio tracks how much of a bank’s loan portfolio has gone sour; i.e., unpaid for 90 days or more. If that number creeps too high, Bangladesh Bank flags it. And public trust? It wobbles badly.

As of early 2025, private banks are keeping NPLs below 5%, but some state-owned banks still hover above 10%. That’s where tighter control and recovery efforts kick in.

Why Does This Matter to You?

If you’re planning to open a business bank account in Bangladesh as a foreigner, or looking into SME loans, or even aiming to invest in one of Bangladesh’s Hi-Tech Parks or BEZA zones, your bank’s credit health affects your financial experience.

Think about it:

- A bank with good credit risk management will process your application faster, offer better loan terms, and have fewer service disruptions.

- A bank that’s overloaded with bad loans? They’ll be too busy firefighting to care about your account upgrade or startup proposal.

So yeah, credit risk sounds like a banker’s term. But at the end of the day, it shapes how stable, safe, and helpful your bank can actually be.

Role of Commercial Banks in Economic Development

If you’re wondering what banks have to do with Bangladesh’s roads, ports, factories, or tech zones, here’s the answer: a lot.

- Infrastructure Loans: Help build power grids, roads, and BEZA projects

- SME Support: Banks fund cottage industries and tech startups

- Job Creation: They indirectly create jobs by funding firms.

- Financial Inclusion: Rural outreach + digital onboarding

Think of them as silent partners in Bangladesh’s GDP growth engine.

Future of Commercial Banking in Bangladesh

Things are changing. Fast. Like bullet trains, or maybe like something else! And…

- Mobile-first banking is no longer optional. It’s expected.

- Agent banking is making rural inclusion a reality.

- Cyber risk is now a serious thing. Banks are investing in security systems.

- Startup-friendly accounts and digital onboarding for foreigners are gaining ground.

If you’re someone setting up in BEZA or a Hi-Tech Park or applying for BIDA clearance, commercial banks are more relevant to your plan than ever.

Final Thought: Banking Isn’t Just Banking Anymore

Let’s be real: commercial banks in Bangladesh are no longer just quiet buildings with long queues and dusty forms. They’re becoming part of your phone, your startup journey, your remittance lifeline.

So next time you think a bank is just for storing money, remember: it’s actually moving the country forward.

FAQ

How many commercial banks are there in Bangladesh in 2025?

Answer: As of 2025, there are 53 commercial banks running across Bangladesh. That number brings together a mix: some are state-owned, some privately owned, and a handful are foreign banks doing business here, too. It’s a pretty diverse lineup serving everything from local communities to global investors.

Which one is the largest commercial bank in Bangladesh?

Answer: Sonali Bank is the largest state-owned one by assets. Among private banks, BRAC Bank and Islami Bank lead the pack.

What types of business banks are there in Bangladesh?

Answer: Bangladesh has state-owned commercial banks, private commercial banks (both conventional and Islamic), and foreign or international commercial banks.

How do commercial banks benefit the economy?

Answer: They fund businesses, manage remittance, drive savings, and support government projects, playing a vital role in GDP growth and job creation.

What is credit risk management in commercial banks?

Answer: It’s the process of ensuring that banks don’t suffer huge losses due to unpaid loans. Tools include borrower profiling, credit ratings, and policy compliance.