“The safest way to double your money is to fold it over and put it in your pocket.”

— Kin Hubbard

Yeah, that sounds a bit funny, if I’m being honest. But when you’re trusting a government bank in Bangladesh, you’re not folding your money. You’re planting it. Hoping it grows roots. Maybe not fast, maybe not fancy, but solid, dependable, and reachable.

So, if you’re asking, ‘Which government bank in Bangladesh should I trust?’ or ‘How many of them are even active?’ you’re just in the right place.

This isn’t just a rundown. It’s a street-smart conversation. Let’s talk banks, yes, but the ones backed by the state. The ones often overlooked in the race for digital flash but still standing tall in agriculture, remittance, pensions, and large public projects.

What Counts as a Government Banks in Bangladesh?

When we say Government Banks in Bangladesh, we’re talking about two major categories:

Category 1: State-Owned Commercial Banks (SCBs)

These are like the “big siblings” in the room. They handle the big state accounts, foreign trade, salary disbursement, and public loans.

Category 2: Specialized Banks (SBs)

Think of these as laser-focused institutions. Some cater only to farmers, others to foreign wage earners, and one even just for Ansars (a paramilitary auxiliary force).

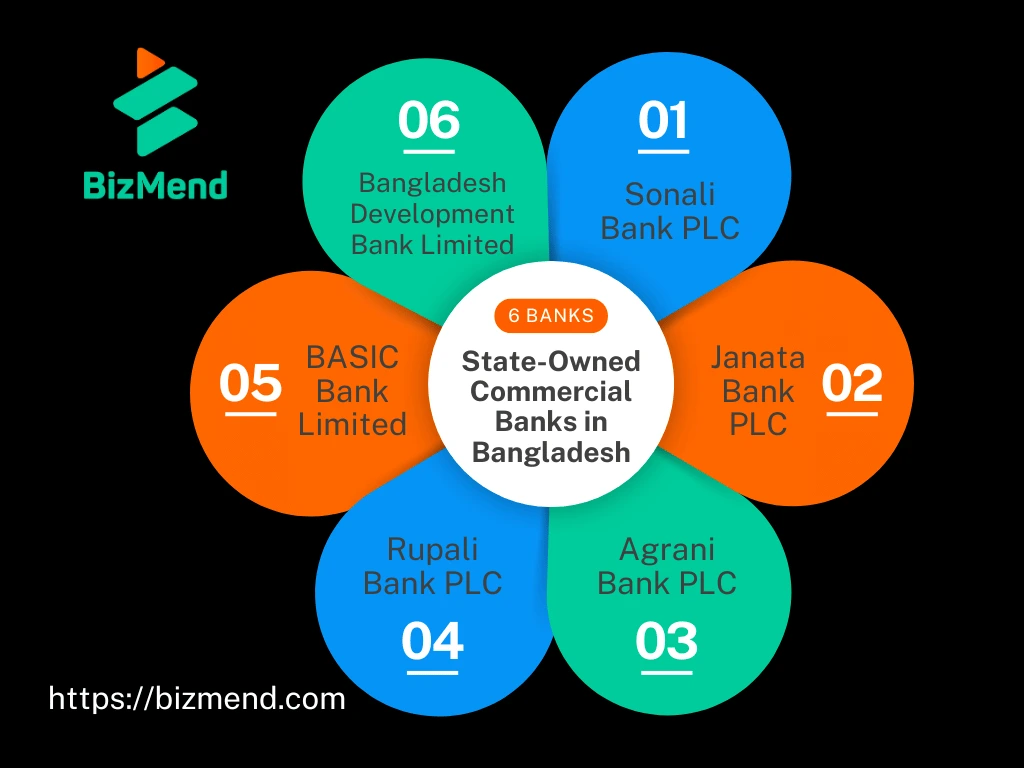

6 State-Owned Commercial Banks (SOCBs) in Bangladesh

If private banks are where innovation brews, state-owned commercial banks are where Bangladesh keeps its backbone steady. These six giants don’t just handle money; they move ministries, manage millions of salaries, and keep the country’s financial blood flowing through pensions, remittances, and infrastructure projects. Each plays a different role, but together, they write the budget’s bottom line.

1. Sonali Bank PLC

A Short Glance

Sonali Bank is the elephant in the room. Not just because it’s the largest state-owned commercial bank, but because it plays a key role in handling government payrolls, pension disbursements, treasury functions, and public project financing. It’s the first stop for many public-sector activities, from BOI/BIDA compliance to education board salary clearances.

Why It’s One of the Best

- Trusted by the Government for treasury management.

- Handles bulk disbursement for civil servant salaries, pensions, and subsidies.

- Crucial for immigrants needing capital repatriation support.

- Frequently used for opening LC on behalf of government bodies.

Core Facts & Capabilities

- Credit Rating: AA– (CRISL, 2025)

- Branches: Over 1,200 across all districts.

- Digital Innovation: Online banking with a core CBS, a real-time gross settlement system, and SMS alerts. The mobile app is still being worked on.

- Remittance: $48.48 million (July 2025)

- SWIFT Code: BSONBDDHXXX

- Other: Boasts the largest coverage for rural treasury disbursement.

Special Services for Foreign Entrepreneurs

- Supports capital repatriation with BOI/BIDA clearance.

- Public project-based vendor accounts (great if you’re a foreign contractor).

- Trusted for import-export LC under joint government projects.

2. Janata Bank PLC

A Short Glance

If you’re looking at industrial backbone banking, Janata Bank fits the bill. It’s a go-to for export-import LC services and public sector-linked business financing. Despite bureaucratic overtones, it remains one of the more agile public banks in large-scale transactions.

Why It’s One of the Best

- Known for serving state-owned enterprises and corporations.

- Expert in export trade settlements and industrial term loans.

- Long-standing correspondent banking relationships.

Core Facts & Capabilities

- Credit Rating: A1 (CRAB, 2025)

- Branches: 900+ nationwide.

- Digital Innovation: Upgraded CBS, basic internet banking for retail, but limited SME modules.

- Remittance: $82.73 million (July 2025)

- SWIFT Code: JANBBDDHXXX

- Other: One of the oldest SOCBs with strong Gulf corridor partnerships.

Special Services for Foreign Entrepreneurs

- Industrial LC processing for EPZ-based businesses.

- Government contractor-friendly account setup.

- Good fit for export-based manufacturing startups.

3. Agrani Bank PLC

A Short Glance

Agrani wears multiple hats. It’s the foreign exchange bank of the public sector and a major remittance receiver. From rural remittances to trade finance, Agrani has mastered the art of balancing government reliability with public reach.

Why It’s One of the Best

- A key player in the remittance game.

- Strong foothold in border banking and land port operations.

- Trusted in migrant-heavy districts for foreign account access.

Core Facts & Capabilities

- Credit Rating: A+ (Alpha, 2025)

- Branches: 950+ branches and sub-branches.

- Digital Innovation: Web banking, e-statement, remittance tracking tools; no full-fledged smart app yet.

- Remittance: $88.39 million (July 2025)

- SWIFT Code: AGBKBDDHXXX

- Other: Active in Indo-Bangla trade corridors and B2B forex settlements.

Special Services for Foreign Entrepreneurs

- Convenient for companies with cross-border transactions.

- Foreign remitters receive faster cash pickups in remote areas.

- Decent forex desk for small-scale capital exchanges.

4. Rupali Bank PLC

A Short Glance

Rupali is the banker of pensions, gratuities, and municipal programs. It’s rooted deeply in public infrastructure projects and serves thousands of semi-government officials.

Why It’s One of the Best

- Known for gratuity and pension disbursements.

- Acts as a key conduit in public development projects.

- SME-friendly despite its size.

Core Facts & Capabilities

- Credit Rating: A– (NCRL, 2025)

- Branches: 600+ across Bangladesh.

- Digital Innovation: Basic retail app, web banking, and agent banking in pilot zones.

- Remittance: $31.99 million (July 2025)

- SWIFT Code: RUPBBDDHXXX

- Other: Frequently linked with pension board compliance payments.

Special Services for Foreign Entrepreneurs

- Public procurement-related LC issuing services.

- Easy salary transfer facilities for NGOs (Non-Governmental Organizations) and INGOs (International Non-Governmental Organizations).

- Friendly toward local-foreign joint ventures.

5. BASIC Bank Limited

A Short Glance

BASIC was founded for SMEs. But over the past decade, it has battled governance issues and is now under tighter regulatory oversight. It still offers limited services, especially to rural or micro entrepreneurs.

Why It’s One of the Best

- One of the few public banks focused entirely on SME lending.

- Offers basic financial products for rural small businesses.

- Still supports account opening for startups in low-capital sectors.

Core Facts & Capabilities

- Credit Rating: B+ (ECRL, 2025)

- Branches: Around 70+ nationwide.

- Digital Innovation: Almost nil. Very limited online interface.

- Remittance: $0.22 million (July 2025)

- SWIFT Code: BKSIBDDHXXX

- Other: Currently under Bangladesh Bank supervision.

Special Services for Foreign Entrepreneurs

- Viable only for very small capital setups.

- Not recommended for high-risk or complex businesses.

- Consult before approaching for LC or trade accounts.

6. Bangladesh Development Bank Limited (BDBL)

A Short Glance

Formed from the merger of Bangladesh Shilpa Bank and Bangladesh Shilpa Rin Sangstha, BDBL is the industrial project bank. If your game is infrastructure, long-term capital, or factories, this is your player.

Why It’s One of the Best

- Finances infrastructure and long-gestation industrial projects.

- Tailored loans for energy, textile, and agro-processing.

- Often used by foreign investors needing long-term credit.

Core Facts & Capabilities

- Credit Rating: A3 (CRAB, 2025)

- Branches: Limited to 48 branches.

- Digital Innovation: Web banking for institutional clients, not retail-focused.

- Remittance: $0.00 (as of July 2025)

- SWIFT Code: BDDBBDDHXXX

- Other: Strong ties with BOI/BIDA, Infrastructure Dev Co, and IDCOL.

Special Services for Foreign Entrepreneurs

- Best suited for foreign direct investors in energy, manufacturing, or industrial parks.

- Offers project-based term loans with extended grace periods.

- Accepts BOI/BIDA-endorsed projects as lending criteria.

All six SOCBs play a different, but often essential role, depending on your business type or funding source. If you’re diving into any of the areas mentioned below:

- Starting a business as a foreigner

- Getting into BEZA or Hi-Tech Parks

- Opening a business bank account

- Getting loan access as a foreign entrepreneur

…knowing which public bank suits what will help you avoid red tape and wasted weeks. And yes, we’ll cover more of that in topics like loan eligibility for foreigners, BIDA approval, and company types foreigners can register; so, if you are interested in learning more, make sure to check our blog page and find out the right blogs for the right answers.

Specialized Government Banks in Bangladesh You Should Know

These banks don’t compete for your daily deposits or city-center branch selfies. They exist for missions. Agriculture. Expat welfare. Rural growth. They don’t often make headlines, but when it comes to pushing deep development or supporting overlooked communities, they punch far above their weight.

Let’s break down who’s who.

1. Bangladesh Krishi Bank (BKB)

A Short Glance

Established in 1973, Bangladesh Krishi Bank (BKB) was born to serve the nation’s roots, literally. Krishi means agriculture, and this bank exists to make sure our farmers don’t just dream, but sow, reap, and thrive.

Why It’s One of the Best

- Largest agri-loan disburser in Bangladesh.

- Operates in the deepest rural corners with credit for farmers.

- Promotes food security and self-employment.

Core Facts & Capabilities

- Credit Rating: Not publicly rated; government-backed

- Branches: 1,030+

- Digital Innovation: Limited but improving. Mobile banking on pilot in rural areas.

- Remittance: Not a core strength

- SWIFT code: BKBABDDH

- Other: 100% state-owned

Special Services for Foreign Entrepreneurs

- Helpful for agritech businesses seeking rural penetration.

- Can aid in leasing agricultural land through cooperative tie-ups.

- Ideal for businesses involved in export-grade food processing.

2. Rajshahi Krishi Unnayan Bank (RAKUB)

A Short Glance

Focused solely on the northwest zone, especially Rajshahi and Rangpur. Think of Rajshahi Krishi Unnayan Bank (RAKUB) as BKB’s local twin, but specialized for drought-prone, underdeveloped regions.

Why It’s One of the Best

- Sole banking focus on the Rajshahi division.

- Supports climate-vulnerable and marginal farmers.

- Offers microloans and seasonal credit facilities.

Core Facts & Capabilities

- Credit Rating: Not available

- Branches: 383

- Digital Innovation: Basic online services are available.

- Remittance: Limited to local use

- SWIFT code: Not commonly used

- Other: Known for subsidized lending during seasonal downturns

Special Services for Foreign Entrepreneurs

- Excellent for NGOs or development agencies.

- Agro-entrepreneurs targeting Rangpur–Rajshahi should consider RAKUB for field-level operations.

3. Probashi Kallyan Bank (PKB)

A Short Glance

Probashi Kallyan Bank (PKB) was formed in 2010 to help our migrant workers and their families. This bank understands that going abroad isn’t just a dream; it’s a lifeline. PKB provides pre-departure loans, savings schemes for migrants, and even reintegration finance.

Why It’s One of the Best

- First bank focused solely on migrant workers.

- Provides soft loans for visa, ticket, and processing expenses.

- Offers attractive savings plans for remittance earners.

Core Facts & Capabilities

- Credit Rating: Under evaluation

- Branches: 80+

- Digital Innovation: Basic; mobile banking services exist

- Remittance: Core service, works closely with BMET and Bangladesh Bank

- SWIFT code: PRKBBDDH

- Other: Operates under the Ministry of Expatriates’ Welfare

Special Services for Foreign Entrepreneurs

- Great for diasporas investing back home.

- Can support expat-led community startups.

- Ideal for joint ventures with NRBs (Non-Resident Bangladeshis).

What About the Other Government Banks in Bangladesh?

Okay, so we’ve walked through the giants. The scheduled ones. The banks you hear about are in salary accounts, LC transactions, and BIDA paperwork.

But Bangladesh being Bangladesh, there’s always a side road. A lane where the lesser-known, government-formed banks work, not under the regular Bank Companies Act, 1991, but still wearing a government badge. These are the non-scheduled banks.

They’re not under Bangladesh Bank’s daily scrutiny. They don’t operate across every city. But they serve highly specific communities: rural savers, jobless youth, cooperative groups, or trained defense members, groups that commercial banks often don’t reach.

They’re not your first pick for opening a business account, but if you’re researching public banking in Bangladesh, you need to know they exist.

Let’s meet the quiet four.

Non-Scheduled Government Banks in Bangladesh

- Ansar-VDP Unnayan Bank

- Ansar-VDP Unnayan Bank was born to serve the members of the Bangladesh Ansar and Village Defence Party (VDP).

- Offers small loans, savings schemes, and community support to those who completed paramilitary training.

- It’s a security force bank, not for commercial use.

- Karmasangsthan Bank

- Karmasangsthan Bank was created to fund self-employment and youth entrepreneurship.

- Think: rural tailoring shops, mini groceries, or startups with goats and a dream.

- Designed for educated but unemployed youth, especially outside big cities.

- Palli Sanchay Bank

- Palli Sanchay Bank helps village women, micro-savers, and grassroots groups gain access to formal banking.

- Works closely with government welfare schemes such as Ekti Bari Ekti Khamar (One House, One Farm).

- Encourages saving, borrowing, and income-generating projects in remote areas.

- Grameen Bank

- Grameen Bank, the world-famous microfinance bank founded by Nobel Laureate Muhammad Yunus.

- Technically not under the Bangladesh Bank, but formed by government ordinance and still state-regulated.

- Serves the unbanked poor, especially rural women, with tiny collateral-free loans.

What About Jubilee Bank? What Happened to It?

If you’ve come across the name Jubilee Bank in old articles or bank lists, here’s the real story:

Jubilee Bank was once a registered entity, but it no longer exists. The government formally dissolved the bank following concerns about its viability and operations. Its registration was revoked by the RJSC (Registrar of Joint Stock Companies and Firms), and by early 2022, the High Court issued a formal order to liquidate it.

A final winding-up notice appeared in the government gazette around March 2021, making the closure official.

So if you see Jubilee Bank mentioned anywhere as a functioning government bank, you’re looking at outdated information. Today, it’s no longer in the picture.

Which Government Bank Works for You?

Let’s face it: just naming the government banks in Bangladesh doesn’t help unless you know which one’s actually useful for what you’re trying to do. So here’s the part where we stop talking like a list and start talking like real advisors.

If you’re…

Setting up shop in BEZA or a Hi-Tech Park?

Whether you’re setting up in a Hi-Tech Park in Gazipur or planning a manufacturing unit inside BEZA’s economic zones, your capital injection, repatriation clearance, and foreign investor paperwork need a bank that knows how the system flows.

Go with:

- Sonali Bank PLC: the trusted gatekeeper for BOI/BIDA-linked projects

- Bangladesh Development Bank Limited (BDBL): ideal for infrastructure and industry-backed financing

They’ve handled investor visas, repatriation certificates, and even direct currency swaps.

Trying to open a business bank account as a foreigner?

This is often the first big hurdle. The form might be short, but the process? Not so much. You’ll want a bank that’s not just aware of foreign business needs but actively handles them.

Go with:

- Sonali Bank PLC: handles most embassy, expat, and BOI-affiliated accounts

- Janata Bank PLC: solid for corporate accounts and LC-backed trade

- Agrani Bank PLC: experienced in urban-to-rural business flow and remittance-linked account setups

These banks are also listed in most BIDA and visa documentation for recommended service providers.

Looking for SME or startup loan options?

You’re a foreign entrepreneur trying to tap into Bangladesh’s loan ecosystem, but not all banks are equipped to handle this with non-resident founders.

Check if these are part of your funding pipeline:

- BASIC Bank Limited: set up with an SME focus (though currently under watch, still operating)

- Janata Bank PLC: excellent for trade-linked SME projects

- BDBL: If your startup is infrastructure-based or high-capital, this is where you knock

Some of these institutions are also referenced in programs under Startup and SME Loans for foreign applicants.

Also, keep them in mind when you need to…

- Register for a Tax ID and plan early filings

- Handle foreign capital repatriation under BIDA oversight

- Provide solvency certificates or financial support letters for leasing or buying commercial space

And fulfilling other compliance requirements that come with registering a company in Bangladesh.

If you’re serious about starting or scaling your business in Bangladesh as a foreign founder, these banks aren’t just financial institutions; they’re part of the paperwork. Literally.

A Quick Word on Private and Foreign Banks in Bangladesh

While government banks hold the roots of public finance, private and foreign banks shape much of the country’s modern banking story.

Private Banks

As of now, 43 private commercial banks operate in Bangladesh, divided into:

- 33 conventional banks, and

- 10 Islamic Shariah-based banks: These are the banks that power your startup dreams, SME loans, smart apps, and those ever-useful debit cards. (If you’re choosing between them, don’t miss the Top 10 Private Banks in Bangladesh blog.)

Foreign Banks

There are 9 foreign commercial banks in operation, most with limited branches but strong global backing.

They don’t chase headlines, but they are very important if you do business across borders, send money to people in other countries, or handle corporate banking for global companies.

In short?

Government banks might be the gatekeepers, but private and foreign banks are often the bridges, especially for those entering the market from overseas.

Final Thought

Government banks aren’t flashy. They don’t headline startup angel networks or boast sparkling apps. But when it comes to:

- State salaries

- Agro-loans

- Migrant schemes

- Long-term capital projects

They hold the key. And as Benjamin Franklin said,

“A small leak will sink a great ship.”

If you want to do business or invest in Bangladesh, understanding your government banks is not an option; it’s a must. Because a bit of information gap or inconsistency can cost you a lot.

They may not be the cutest in your pitch deck, but when the system needs structure, they’re the ones holding it steady.

FAQs on Government Banks in Bangladesh

Can a foreigner open an account with government banks in Bangladesh?

Answer: Yes, but it’s not instant.

You’ll need proper paperwork like your passport, BIDA or work permit approval, and business registration documents. Banks like Sonali, Janata, and Agrani regularly handle foreign business and expat accounts, but expect some back-and-forth, and always double-check with their foreign desk, if they have one.

Which government banks in Bangladesh offer best for BOI/BIDA-related services?

Answer: In this case, Sonali Bank PLC is your safest bet.

It’s often the default pick on official forms and project applications. Whether you’re bringing in capital or applying for repatriation clearance, Sonali’s familiarity with BOI/BIDA-linked services makes it a key player, especially for projects tied to getting BIDA Approval or starting in BEZA or Hi-tech parks.

Are government banks in Bangladesh slower than private banks?

Answer: Usually, yes. But not always.

Think of government banks in Bangladesh like old steam engines: not the fastest, but powerful and deeply connected to public systems. If you’re doing anything that involves government paperwork, visa approval, taxation, or long-term infrastructure, these banks are actually more aligned than some fast-paced private ones.

Can I apply for a startup or SME loan from a government banks in Bangladesh?

Answer: You can. But not all banks offer it openly to foreigners.

BASIC Bank is SME-focused (though proceed with caution), while Janata and BDBL handle project loans and startup capital in specific sectors. You’ll often need to show local traction, a registered entity, and in some cases, a resident director. Check the specific eligibility under Startup and SME Loans for foreign applicants.

Which government banks in Bangladesh supports the repatriation of profits?

Answer: Sonali Bank and Agrani Bank lead here.

They’re trusted by BIDA and the Bangladesh Bank to verify audited reports, process clearance certificates, and handle the actual foreign transfer. Just make sure your books are clean, and your exit route is as planned as your entry.