“If commercial banks run the city, specialized banks light up the villages.”

We don’t usually think about where our loan comes from until the big names say no. That’s where specialized banks in Bangladesh step in. These aren’t your everyday deposit-ATM-credit card setups. These are institutions with a purpose: to support the sectors no one else prioritizes.

From farmers in Pabna to returning NRBs in Sylhet, specialized banks in Bangladesh exist to do what others skip: fund agriculture, small industry, exports, and housing.

So if you’ve been wondering why they exist, who they help, or whether your business should care, this is where it all comes together, minus the noise.

What Is a Specialized Bank in Bangladesh?

Let’s start with the very definition of specialized banks in Bangladesh:

A specialized bank is a government-backed institution created to serve a specific economic sector, whether it’s farming, housing, SME lending, or export growth. These banks don’t operate for general public deposits or wide-scale consumer banking. Instead, their role is mission-first.

They exist because Bangladesh needs financial institutions that focus more on impact than short-term profit, especially in rural, underserved areas.

So while commercial banks chase high-credit profiles, specialized banks deal with the kind of clients who run this country but don’t always qualify for traditional loans.

Here’s what they focus on:

- Agricultural development

From irrigation loans to crop financing, they make sure the rice gets harvested.

- SME and cottage industries

That weaving machine in Cumilla? Or that mini bakery in Khulna? Specialized banks help keep those dreams alive.

- Housing and construction finance

Not every home loan has to come with three guarantors and an urban salary. These banks understand rural realities.

- Export facilitation

They step in when your jute or leather shipment needs credit, and the big banks just shrug.

- Migrant worker remittance support

They make sure those hard-earned foreign remittances don’t get eaten up by delays or bad exchange rates.

So no, they don’t compete with traditional banks. They complement them. They cover the ground where others don’t even look. If commercial banks work the headlines, specialized banks take care of the footnotes that keep the story running.

Why Does Bangladesh Need Specialized Banks?

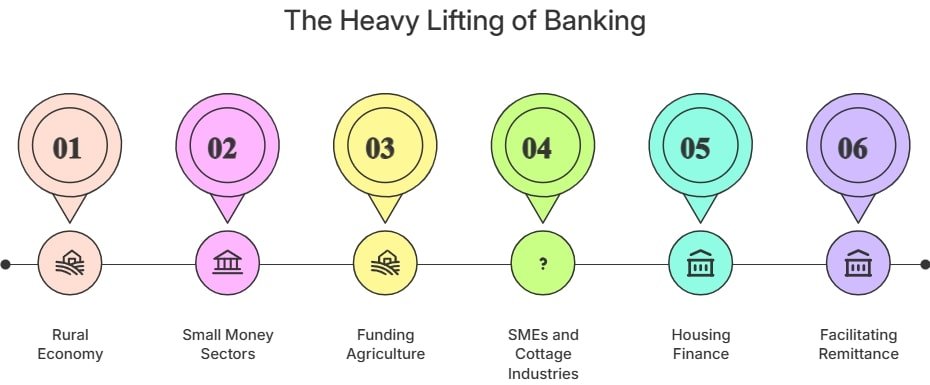

Let’s be honest: our economy isn’t built entirely inside Gulshan offices or industrial zones. A huge chunk lives in rural towns, export sheds, and family-run factories.

But here’s the catch: big banks often skip the “small money” sectors. That’s not where their margins are.

- They fund agriculture, where returns are slow but essential.

- They support SMEs and cottage industries, which employ millions but often lack financial paperwork.

- They build housing finance systems that cater to real people, not just corporate towers.

- They facilitate remittance, helping NRBs and their families.

In short, they handle the heavy lifting where it really counts. But rarely gets noticed.

List of Specialized Banks in Bangladesh (2025)

Let’s keep it real: while many banks in Bangladesh wear the ‘public service’ badge, only three banks officially carry the title of “specialized bank” under the Bangladesh Bank.

They’re not here for savings accounts, credit cards, or business lounges. These are banks built for very specific missions, and they’ve been doing it long before fintech got flashy.

As of now, there are 3 specialized banks in Bangladesh, all state-owned, and each laser-focused on solving problems that commercial banks rarely touch. Let’s have a quick look at the list:

| Bank Name | Focus Area | Website |

| Bangladesh Development Bank Limited (BDBL) | Industrial finance, project lending, SME support | https://bdbl.com.bd/ |

| Bangladesh Krishi Bank (BKB) | Agriculture, rural livelihoods, small farming | https://krishibank.gov.bd/ |

| Rajshahi Krishi Unnayan Bank (RAKUB) | Regional agriculture and economic development | https://www.rakub.org.bd/ |

Now, a brief discussion on those specialized banks in Bangladesh:

Bangladesh Development Bank Limited (BDBL)

Focus: Industrial finance, SME support, and project lending.

BDBL is the product of a merger between two legacy institutions (BSB and BDFCL). These days, it’s like Bangladesh’s behind-the-scenes banker for industries, backing factories, power plants, agro-processing setups, and even the occasional tourism project. Whether you’re setting up machines in Narayanganj or launching an agro unit in Cumilla, BDBL could be your first stop for financing.

Why it matters: When private banks hold back, BDBL is the one keeping industry dreams on the table.

Bangladesh Krishi Bank (BKB)

Focus: Agriculture.

This is the OG of rural banking in Bangladesh. If there’s paddy in the field or jute in a warehouse, chances are BKB had something to do with financing it. They’re the ones who stand by farmers. With crop loans, seasonal loans, and refinancing, when things get tight. But it doesn’t stop there. They support agri-SMEs, help out fisheries, and even show up for dairy farmers when they need it.

Why it matters: In a country where farming still fills the GDP, and our dinner plates, BKB is that quiet, steady hand behind every harvest.

Rajshahi Krishi Unnayan Bank (RAKUB)

Focus: Northwest region; Rajshahi, Rangpur, and beyond.

RAKUB is the only region-specific bank in the country, and it exists for a reason. The northwest is rich in farming potential but often ignored by big banks. RAKUB supports everything from potato farmers to mango exporters, with an emphasis on local economic empowerment.

Why it matters: If your roots, or your business, lie in the country’s northwest, this is your go-to finance friend.

Specialized Banks vs. Commercial Banks in Bangladesh

Alright, let’s clear the fog. You might be wondering: “Aren’t all banks more or less the same?” Short answer, not even close!

A specialized bank in Bangladesh doesn’t try to be everything for everyone. It’s designed to serve a purpose. A very specific one. Commercial banks? They’re here for volume, margins, and mass banking.

Here’s where the line is clearly drawn:

| Area | Specialized Banks | Commercial Banks |

| Target Audience | Farmers, small manufacturers, rural workers, development projects | Urban professionals, corporates, large deposit holders |

| Purpose of Lending | National development, sector support, financial inclusion | Business profit, retail growth, asset expansion |

| Flexibility | Understand seasonal incomes, irregular earnings, or land as collateral | Strict documentation, salary-based EMI plans, credit score obsession |

| Branch Presence | You’ll find them in the corners of the country you never knew had banks | High-traffic zones, commercial hubs, prime urban spaces |

| Ownership | Government-owned with policy-driven missions | Mix of private, foreign, and public shareholding models |

So the next time someone says “Just go to a bank,” ask which kind. Because if you’re growing mangoes in Rajshahi, running a jute mill in Khulna, or setting up a factory outside the city, you’re probably not a City Bank kind of client.

You’re more likely to find your solution with a specialized bank built for the sector you’re in.

Why It Matters to You

If you’re thinking:

- “How do I get a project loan?”

- “Who will finance a local agri-export startup?”

- “Can I get housing finance outside Dhaka?”

- “Do foreign investors get access to development banks?”

Then you need to know these banks.

From figuring out SME loans to setting up inside Hi-Tech Parks, these institutions show up where policy meets practice.

They may not advertise on billboards, but they’re listed in the files of BIDA, the Ministry of Finance, and yes, probably the same regional office you’ll be visiting next month.

And What About Other Banks in Bangladesh?

Now, if you’re wondering, “Okay, I get what a specialized bank is… but what about all the other banks I see around every day?”—very good question. Let’s quickly sketch the rest of the picture:

Private Commercial Banks

These are the banks you probably have an account with: cards, apps, personal loans, flashy billboards, all of it. From EBL and BRAC Bank to Prime Bank, these institutions run on competition and customer volume. They focus on profit, but also on efficiency and service. Want a savings account with cashback? This is your turf.

Curious which ones are worth your time? We’ve covered the best private banks in Bangladesh in detail.

Government-Owned Banks

These are the big boys: Sonali, Janata, Agrani, and the rest. They have the widest branch networks, deep ties to public sector payments, and often handle pension disbursement, salary accounts, and welfare transfers. They’re not always the fastest, but they’re often the only ones present in remote corners of the country.

There’s a full breakdown of government banks in Bangladesh if you’re comparing them head-to-head.

Foreign Banks

Yes, they exist here too. Standard Chartered, HSBC, and a few others operate in Bangladesh, mostly catering to international trade, foreign businesses, and large corporates. If you’re a foreign investor, you’ll probably deal with them, at least for initial fund transfers, trade finance, or dual-currency accounts.

Our separate piece on foreign banks in Bangladesh walks through what they offer and who they serve best.

Special Addition: Non-Bank Financial Institutions (NBFIs)

Ah, yes, the “in-betweeners.” NBFIs or Non-Bank Financial Institutions, don’t have regular bank licenses, so you won’t find savings accounts or ATMs. But they offer loans, leasing, housing finance, and SME support, especially in sectors that need more flexible terms. If you’re eyeing alternative credit solutions, you might end up knocking on their door instead of a bank’s.

And Who Keeps All This in Check?

The Bangladesh Bank. It’s the central bank. The financial referee. They don’t just print money and host press conferences. They’re the ones who decide who gets licensed, who’s breaking rules, and who needs a little slap on the wrist.

From setting interest rate policies to overseeing digital currency experiments, they quietly keep the system moving without letting it overheat.

And yes, they also zone banks into red, yellow, or green, based on how risky or stable they are. It’s their way of saying: “We’re watching who’s doing their homework, and who isn’t.”

Final Thought

Specialized banks aren’t loud. They’re not chasing app downloads or premium accounts. But look closer, and they’re funding things that hold up the economy’s backbone: rice fields, jute exports, remittance services, rural entrepreneurs.

In a country where one size rarely fits all, these banks are Bangladesh’s way of saying, “Not everyone needs a platinum card. Some just need a hand.”

Whether you’re planning to invest in one of Bangladesh’s top sectors or simply figuring out your bank account type, knowing where specialized banks fit in tells you a lot about what this country values.

FAQ

How many specialized banks are there in Bangladesh?

Answer: Only three. That’s it. Not five. Not six. These are:

- Bangladesh Development Bank Limited (BDBL)

- Bangladesh Krishi Bank (BKB)

- Rajshahi Krishi Unnayan Bank (RAKUB)

Each has a specific development goal, and all three are state-owned. If you ever see someone list more than three, don’t believe the brochure.

What is the actual function of a specialized bank in Bangladesh?

Answer: To fund what others won’t.

The function of a specialized bank in Bangladesh is to offer credit and support where the market doesn’t naturally go, agriculture, regional industries, and rural livelihoods. They focus on sector-first, not profit-first.

Can I open a personal account with a specialized bank?

Answer: Technically, yes, but that’s not really what they’re for.

These banks aren’t built for daily transactions or cards. If you need a full-service retail experience, check out a private or government bank instead. Specialized banks are mission-driven, not mass-market.

Are foreigners allowed to work with specialized banks?

Answer: Yes. But with a twist.

If you’re a foreign investor working in agriculture, infrastructure, or manufacturing, you might deal with them through project financing or BIDA-linked programs. But walk-in services? Not really their thing.

What’s the difference between commercial and specialized banks in Bangladesh?

Answer: Here’s the simplest way to put it:

Commercial banks try to serve everyone.

Specialized banks are built to serve someone.

If you’re a rice farmer, rural entrepreneur, or public housing applicant, you’ll feel that difference in your loan paperwork.

Why is BDBL considered a specialized bank but not Sonali Bank or PKB?

Answer: Because BDBL was formed with a mandate for industrial and SME finance, and is officially listed under Bangladesh Bank’s “specialized” category.

Sonali, Janata, PKB, they’re public or sector-specific banks, but not classified as specialized commercial banks in Bangladesh.

Is there a full list of specialized banks somewhere official?

Answer: Yes. You can verify the list on the official website of Bangladesh Bank, or via the curated summaries at banksbd.org. Just make sure you’re reading the current list, not an old blog that adds NBFIs by mistake.