“Borders are a concept. Business is universal. Build where it works for you.”

“Is It Actually Possible for Me to Start a U.S. Company from Bangladesh?”

Let’s be honest—this question crosses the mind of every digital entrepreneur, freelancer, or small business owner from Dhaka to Chattogram.

You’re working with international clients. You’re using platforms like Fiverr, Upwork, Etsy, or Shopify. You’ve got an audience outside the country. You’re thinking: “Why not play the game properly?”

Forming a US company from Bangladesh isn’t just a dream anymore. It’s a practical strategy. It helps you:

- Receive international payments (think: Stripe, PayPal, Mercury)

- Sign contracts with credibility

- Build a global brand

- Access investors and venture platforms

So if you’re a Bangladeshi founder wondering how to go about it, this blog’s written exactly for you.

First, Can Bangladeshis Really Register a US Company?

Yes, 100%.

You don’t need a U.S. passport, a visa, or even to set foot in the States.

Bangladeshis can open a US LLC or C Corporation remotely. And the process is smoother than most people think. The two most popular states to start with?

- Delaware, known for being startup- and investor-friendly.

- Wyoming, loved for its privacy, low annual fees, and simplicity, especially for solopreneurs or small teams.

So whether you’re a Shopify dropshipper in Narayanganj, a SaaS founder from Dhanmondi, or a service provider scaling internationally, you’re good to go. From your laptop, right where you are.

For a clear picture, see:

Why Many Foreigners Choose Delaware for Their LLC

Why Start Your Company in Wyoming: Pros & Cons

So, What’s the Process Like?

Here’s an easy and simplified version tailored to Bangladeshi founders.

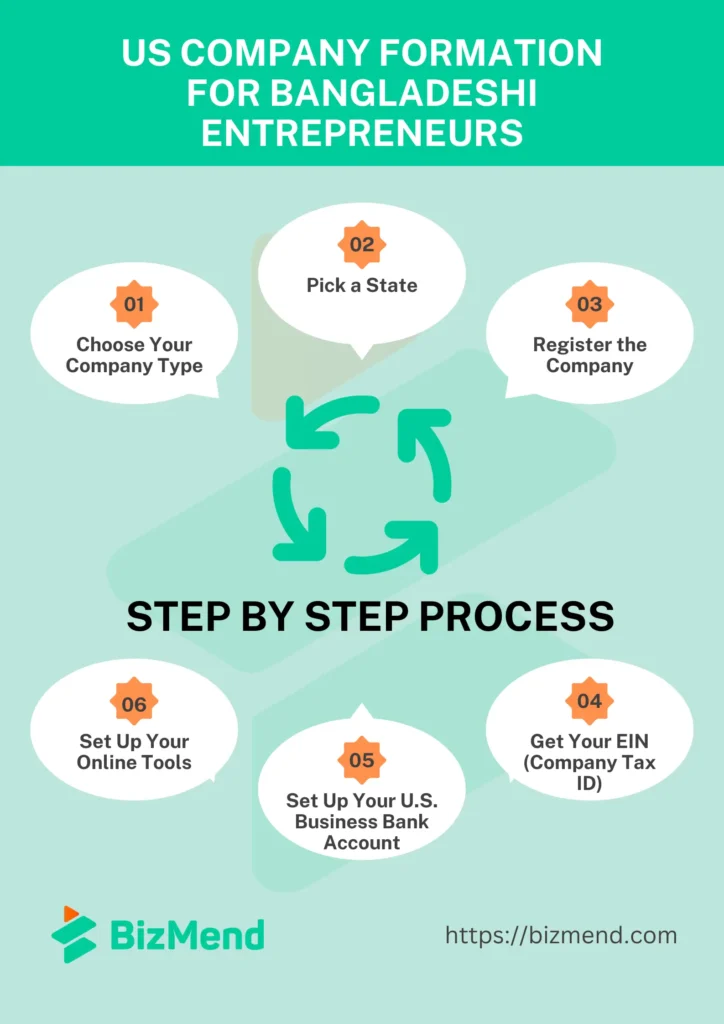

Step 1: Choose Your Company Type

The most popular and flexible choice? An LLC. (Not sure what that is? Head to US Company Registration or Difference Between LLC and C Corporation.)

Remember: You can’t form an S Corp if you’re a non-resident. So just ignore that for now.

That said, many tech-focused founders opt for a C Corporation—especially if they’re planning to raise funds in the future. C Corps are better for issuing shares and attracting investors. But they come with more rules, double taxation, and extra paperwork. So choose based on your long-term goals.

Step 2: Pick a State

Most Bangladeshis go for:

- Delaware (low friction, privacy, startup-friendly)

- Wyoming (cheaper fees, anonymity)

- California (if you’re targeting the West Coast or US tech culture)

Step 3: Register the Company

You’ll need:

- A business name (check if it’s available)

- A Registered Agent in your chosen state

- A US address (often provided by your registered agent or a Virtual Office)

Then, you file your Articles of Organization (for LLC) or Articles of Incorporation (for C Corp).

Easy to do through a third-party or DIY with expert guidance.

Step 4: Get Your EIN (Company Tax ID)

Think of this as your business’s NID. You’ll need it to:

- Open a bank account

- File taxes

- Sign up for Stripe or PayPal

The good news? You don’t need an SSN to get an EIN. It’s just a bit slower (you’ll fax Form SS-4). See: Getting an EIN for Your U.S. LLC.

Step 5: Set Up Your U.S. Business Bank Account

Options include:

- Mercury

- Relay

- Wise

Some even offer Bangladeshi founders access without visiting the US.

Step 6: Set Up Your Online Tools

Once your LLC is formed and your bank account is live, go ahead and connect:

- Stripe, PayPal, Payoneer

- Your Shopify or Amazon seller account

- Google Workspace, Slack, or Notion

What About Taxes?

Yes, as a Bangladeshi non-resident, your tax obligations depend on:

- Your company structure

- Whether you’re running a trade or business in the U.S.

- Whether you’ve appointed a US-based director

Most single-member foreign-owned LLCs file Form 5472 + pro forma 1120 each year.

C Corporations, on the other hand, must file a corporate tax return (Form 1120) and pay federal taxes on net profits. If you later withdraw those profits as dividends, you’ll also pay withholding tax, making it a “double taxation” structure.

Bangladeshi Founders We’ve Seen Go Global

From e-commerce stores to digital agencies, Bangladeshis are increasingly building US-registered companies.

And they’re not doing it to “hide” money or chase buzzwords.

They’re doing it because:

- Local banks don’t support PayPal or Stripe

- Clients ask for US invoices

- Online marketplaces are strict about the country of origin

If you’re in this crowd, you’re not alone.

Final Thoughts: Building from Bangladesh, Selling to the World

Here’s the truth: You don’t need a Silicon Valley zip code to build global impact.

All you need is structure, clarity, and a bit of legal setup.

Forming a US company as a Bangladeshi entrepreneur gives you the freedom to work with anyone, anywhere, without currency restrictions or payment limitations.

Whether you’re forming a lean LLC or a full-scale C Corporation, what matters is that your business is real, registered, and ready.

So if you’re sitting in Banani or Barisal, and you’re dreaming of something bigger, don’t wait for the “perfect time.”

Because this is it.

FAQs of U.S. company Formation from Bangladesh

Can I open a U.S. company from Bangladesh without a visa?

Yes, 100%.

You don’t need to step foot in the U.S. to register a company there. Everything—from choosing your state to getting your EIN—can be done online. Just remember: company ownership ≠ immigration rights.

Do I need a U.S. partner or a local director?

No.

You can fully own your company, all by yourself. The U.S. doesn’t require a local resident or director for LLCs or C Corps. But you do need a registered agent with a U.S. address. Also, an authorized signatory is needed for almost all business bank accounts.

(See: Virtual Office vs Registered Agent)

Which state is best for Bangladeshi founders? Delaware, Wyoming, or California?

Here’s the short version:

- Delaware: Best for startups, fundraising, or future investors

- Wyoming: Great for privacy and low maintenance costs

- California: Only go here if you plan to live/work there

What’s the total cost of forming a company from Bangladesh?

It depends on your state and service provider, but roughly:

- LLC formation fee: $100–$300

- EIN application (without SSN): Free (if self-filed) or ~$75–$100 (via filing service)

- Registered agent (yearly): $49–$150

- Bank/account setup: Often free with online banks like Mercury or Relay

Do I need an SSN or ITIN to get an EIN?

No.

As a non-resident, you can still get an EIN for your U.S. company without a Social Security Number. You’ll need to apply either by fax or through a trusted service provider. (Also, read through Get an EIN Compliantly for Your US LLC to learn more)

Will I be taxed in the U.S. if I’m living in Bangladesh?

It depends.

If your U.S. company has U.S. source income, tax obligations apply. But if your income is fully foreign and you structure things smartly, you may avoid double taxation. Always consult a cross-border tax expert.

Can I get PayPal, Stripe, or Wise with my U.S. company?

Yes, but only if your company is properly structured, has an EIN, U.S. bank account, and a working business model. Stripe, for example, supports non-U.S. founders via Atlas or direct registration.

Can I sell on Amazon U.S. as a Bangladeshi entrepreneur?

Absolutely.

You’ll need:

- A U.S. LLC or C Corp

- U.S. bank account (like Mercury or Payoneer)

- EIN

- Amazon seller documents (ID, utility bill, etc.)

How long does the whole process take?

On average:

- Company formation: 2–5 business days

- EIN: 1–3 weeks

- U.S. bank account: 5–10 days

- Stripe/Amazon setup: Within days of verification

(Timelines vary case-by-case and depending on other scenarios)

I’ve never done this before. What if I make mistakes?

You’re not alone. Most first-time founders feel this way.

To avoid rookie errors, check out: